Dubai’s real estate market hit almost $400 million in tokenized property sales amid major institutional moves, including RWA inclusion in VARA guidelines and the launch of a government-backed RWA platform by the DLD.

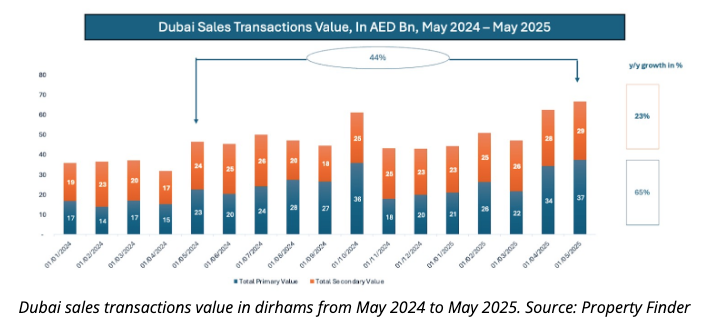

Dubai has long been a global hub for real estate investment, and recent developments have catapulted its market into the digital finance sphere. In May, the emirate recorded a staggering $399 million in tokenized property sales, which accounted for 17.4% of total transactions. This surge in activity coincided with a broader property boom that saw total sales soar to 66.8 billion dirhams (approximately $18.2 billion) across nearly 18,700 deals. As reported by Cointelegraph, these figures highlight a vibrant market that is increasingly embracing technological innovations.

This milestone is not merely a statistical anomaly; it is a reflection of significant regulatory and institutional movements aimed at enhancing the landscape for real estate tokenization in Dubai. On May 19, the Virtual Asset Regulatory Authority (VARA), Dubai’s crypto regulatory body, updated its guidelines to officially incorporate real-world asset (RWA) tokenization. This pivotal development is set to bolster investor trust and stimulate further adoption in a rapidly evolving market.

Adding to this encouraging landscape, on May 25, the Dubai Land Department (DLD) unveiled a groundbreaking tokenized real estate platform in collaboration with the Central Bank of the UAE and the Dubai Future Foundation. This new platform enables investors to purchase fractional ownership in secondary-market properties, thereby democratizing access to various real estate opportunities. The initiative is a significant stride towards modernizing property transactions and enhancing liquidity in the market.

The implications of these developments go beyond mere financial figures; they signify a transformation in how real estate transactions are conducted in Dubai. Tokenization allows for smaller investment amounts, which can attract a broader base of investors who may have previously felt excluded from the traditional real estate market. This innovation also facilitates the buying and selling of property interests with unprecedented ease, simplifying what has often been a cumbersome process.

The real estate tokenization trend in Dubai is part of a larger global movement towards integrating blockchain technology into various industries. The advantages are clear: enhanced transparency, improved liquidity, and greater accessibility for investors. As such, markets around the world are now watching Dubai closely as it navigates this new frontier in real estate.

In summary, Dubai stands at the forefront of a transformative moment in the real estate industry, blending traditional investment practices with cutting-edge technology. As tokenized property sales continue to flourish, the regulatory backing and innovative platforms being developed will likely shape the future of real estate transactions not only in the UAE but potentially on a global scale as well.