Dubai, Palm Beach and Miami Lead the Way

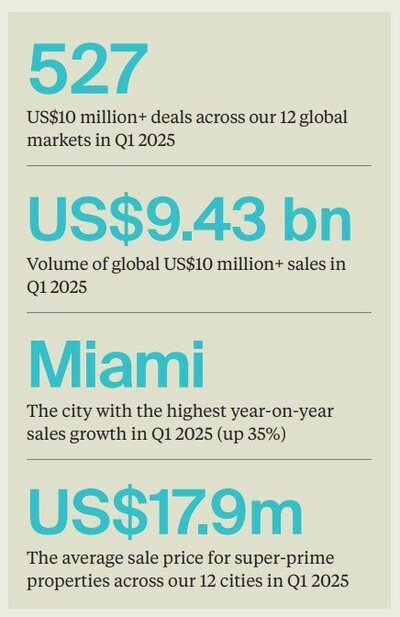

In a world where ultra-wealthy individuals are continually reshaping the landscape of luxury real estate, 2025 has already shown promising signs for the super-prime segment of the market, defined by homes sold for $10 million or more. The first quarter of this year brought with it an impressive resurgence, with data from Knight Frank revealing a 6% increase in both the number of transactions and total sales value compared to the same quarter last year. The number of super-prime deals soared to 527, equating to a staggering $9.43 billion in total transaction value.

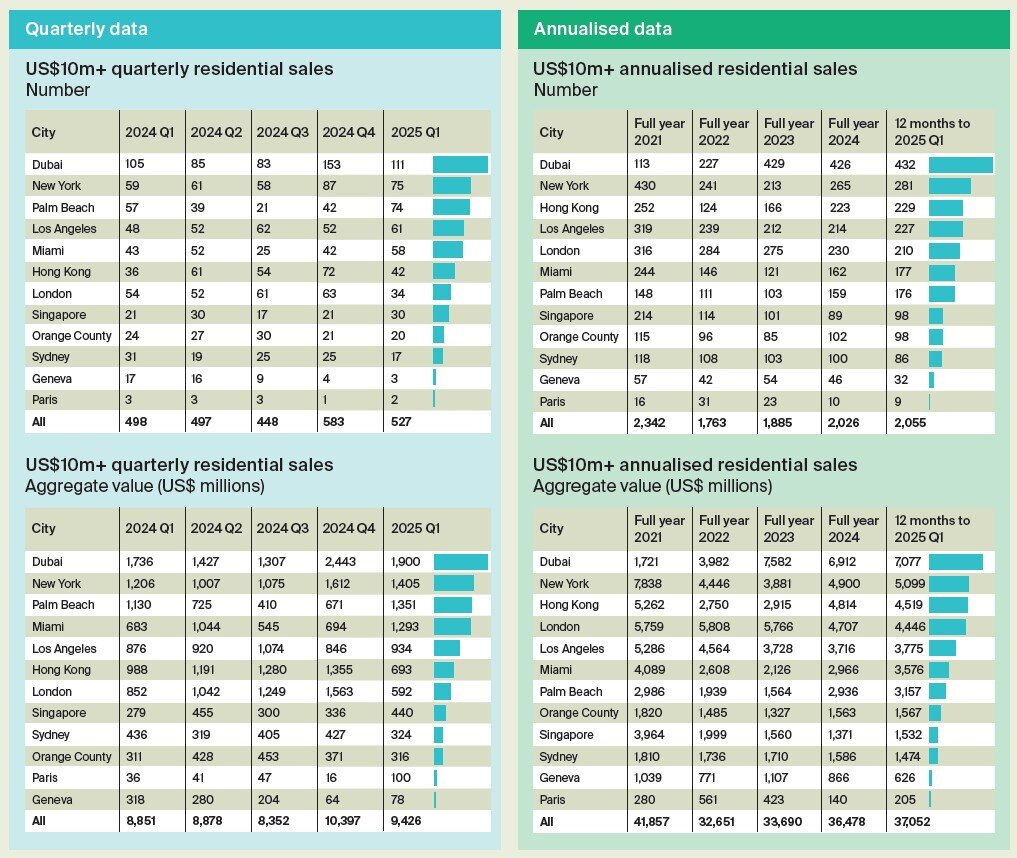

Once again, Dubai emerged as the frontrunner, marking its fifth consecutive quarter at the top with 111 deals worth $1.9 billion. The alluring blend of tax advantages and a strategic global position continues to draw ultra-high-net-worth individuals (UHNWIs) to this vibrant Emirate. Meanwhile, South Florida, particularly Palm Beach, made headlines with a remarkable rebound—recording 74 deals valued at $1.35 billion, compared to just 21 transactions in Q3 2024. Miami also shone brightly, with 58 sales amounting to $1.29 billion, a remarkable 35% year-on-year rise in deal count that nearly doubled its previous value.

New York remains a significant player in the super-prime market, contributing 75 deals worth $1.41 billion. This positions the city as the top Western market in terms of volume, demonstrating its enduring appeal despite the evolving dynamics of luxury real estate.

However, the situation in Asia and Europe presents a more mixed narrative. Hong Kong, for instance, experienced a sharp year-on-year decline, with transactions plunging 31% to just 42 deals, and the total transaction value halving to $690 million. London mirrored this trend, with only 34 deals translating to a total value of $590 million—a 37% drop. Factors such as seasonal slowdowns post-year-end and changing local policies, particularly taxation adjustments in the UK, have contributed to these declines, highlighting the nuances of regional markets.

Over the past 12 months, global super-prime sales totaled 2,055 deals, with Dubai again leading the pack with 432 transactions amounting to $7.08 billion. New York followed closely with 281 deals worth $5.10 billion, while Hong Kong maintained its position in the top three with 229 sales totaling $4.52 billion.

“The super-prime market hit a new gear entering 2025,” remarks Liam Bailey, Knight Frank’s global head of research. “Dubai maintains its lead, but the resurgence of South Florida and the rebound in Hong Kong show that demand remains truly global. As we move through the year, we can expect healthy deal flow; yet, rising macroeconomic uncertainties will necessitate careful navigation for both developers and investors.”

The factors driving this remarkable growth include the rise of global wealth, as highlighted in Knight Frank’s Wealth Report, which noted a 4.4% increase in the UHNWI population in 2024. Trends such as lifestyle migration, tax arbitrage, and the desire for portfolio diversification continue to shape buyer behavior. Despite these strong fundamentals, market participants will need to stay vigilant, contending with headwinds such as interest rate fluctuations, currency volatility, and policy interventions.

Real Estate Listings Showcase